There are many things to consider when you make the decision to retire. First of all, do not confuse “retirement eligibility” with “being financially able to retire.”

Other considerations are:

-

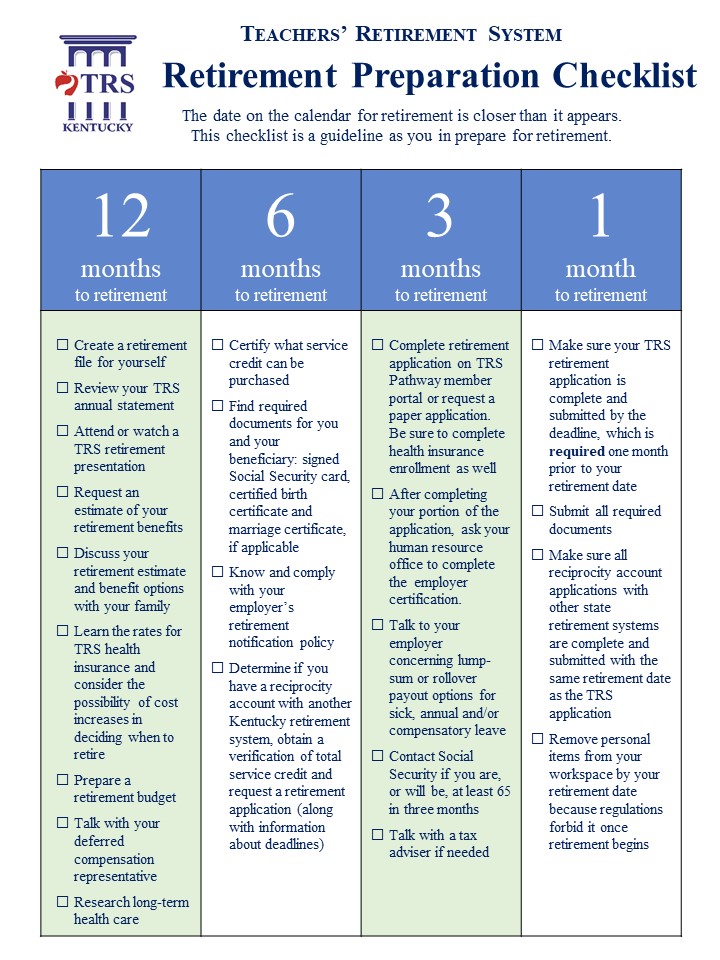

- There are many things to consider when making the decision to retire: Have I attended a retirement workshop, seminar or webinar?

- Are there ways to strengthen my benefit before I retire?

- Are there leaves of absence or lost days I am eligible to purchase that will strengthen my retirement benefit?

- Do I understand how sick leave may be used in my benefit calculation?

- Have I contacted TRS to request an estimate of my retirement benefit with my projected retirement date?

- What is the difference in my monthly benefit by using the average of my high three salaries rather than my high five salaries?

- How do I attain the average of my high three salaries?

- Do I know what the health insurance options are in retirement and the cost to me for health insurance in retirement? (Video: https://trs.ky.gov/home/seminars-workshops/videos/#KnowInsurance)

- Do I have a financial plan?

- Are you working past age 65?

- If I am considering returning to work with a TRS employer, do I the rules and options for returning? A return to work with a TRS employer cannot be arranged prior to retirement; such arrangements are illegal.

Financial planners recommend retirement income of between 80% and 100% of your final salary depending on the adequacy of provided health insurance.

To answer your questions regarding your individual retirement planning, contact TRS at 800-618-1687, between 8 a.m. and 5 p.m. ET, Monday through Friday.