The Teachers’ Retirement System of the State of Kentucky (TRS) is a plan that provides retirement benefits, including annuities and health insurance, for the state’s public school teachers. The plan is administered by an 11-member Board of Trustees. Elections are held annually for the trustees who are elected by members and annuitants.

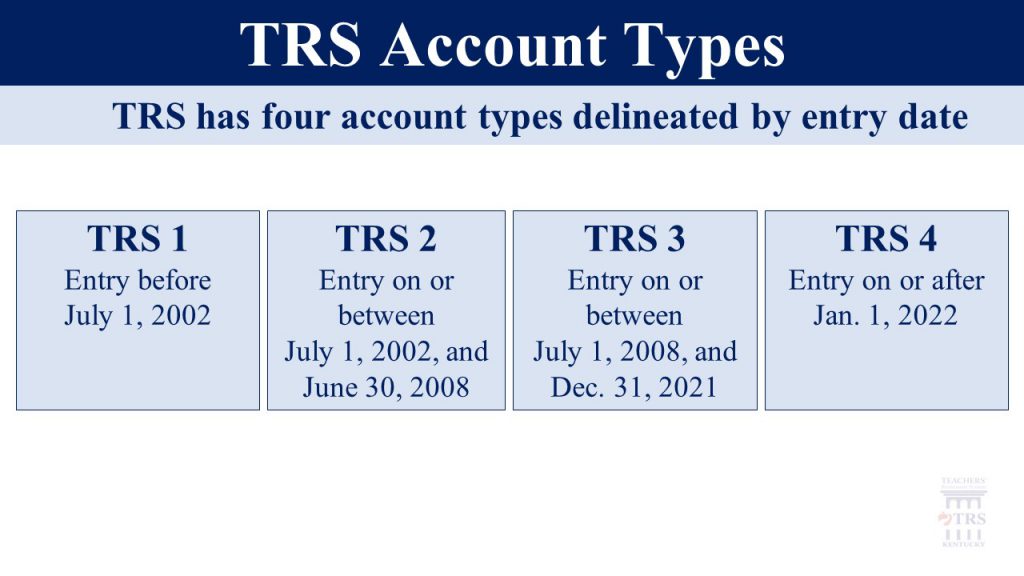

TRS began operations in 1940. Since then, law changes resulted in several plan revisions with benefits determined by when the individual first became a member of TRS.