Any information on this page should not be considered the only advice needed. Rules and forms likely will differ for retirees who now live outside Kentucky. Retirees may want to confer with a tax adviser for tax form preparation. TRS has no liability in providing this general guidance. It is a member’s responsibility to declare the proper amount of taxable income on income tax returns.

1099-R

TRS mails 1099-R tax forms at the end of every January.

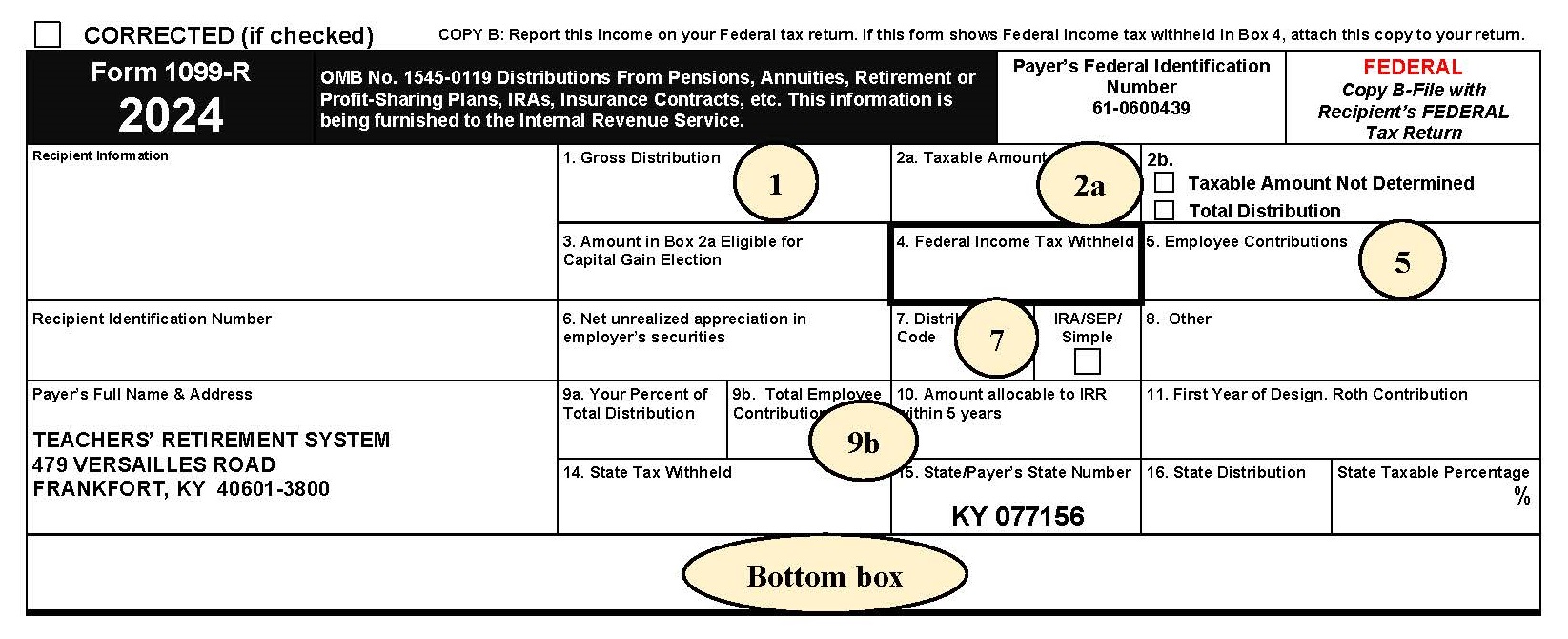

Box 1: Shows total pension benefit before withholding.

Box 2a: Shows taxable portion of benefit. If blank, “Taxable Amount Not Determined” in Box 2b should be marked.

Box 5: Shows the amount member personally contributed to what was received. The Box 5 amount is nontaxable and is not used on personal returns (i.e. IRS Form 1040, Ky. Form 740).

Box 7: Generally, the box 7 value is defaulted to “7” for most benefit types. However, depending on the member’s individual circumstances, the distributions may have been coded differently. Refer to the following distribution codes for more detail:

1 – Early distribution, no known exception

2 – Early distribution, exception applies

3 – Disability

4 – Payment to beneficiary or beneficiaries based on death of active or retired member

7 – Normal distribution

G – Direct rollover

Box 9b: Only used in first year of retirement to show amount of previously taxed contributions.

Bottom box: Includes posttax insurance premiums paid, if applicable.

Kentucky state tax laws

With the understanding that no pension income from Kentucky public service before Jan. 1, 1998, is taxable, Kentucky law also excludes up to $31,110 in pension income from state tax. Don’t forget to apply the Kentucky pension income exclusion against the amount taxable by the state.

Here’s how:

The Kentucky return begins with the federal adjusted gross income, which is on line 5 of Form 740. But that figure can be lowered using the above-referenced pension-income deduction.

If you have Kentucky service before Jan. 1, 1998, use Schedule P to calculate the amount of your pension income that is exempt from Kentucky taxes.

For retirees, regardless of when the service occurred, the amount of the pension deduction is reported on Schedule M along with any other deductions.

Federal taxes

Upon retirement you must report your federal taxable income to the IRS. Under federal tax law, members must pay taxes on their tax-sheltered annuities. If you made contributions prior to August 1982 or made personal payments to the retirement system, TRS will calculate the amount of your contributions upon which you already have paid federal income tax and will report on the 1099-R the amount of your annuity that is still subject to income tax.

Withholding

Withholding is optional, but failure to properly withhold for taxes could result in penalties. Withholding elections may be made at retirement or the time of a disbursement using the appropriate application or the withholding forms available elsewhere on the TRS website. The federal withholding form is separate from TRS’s Kentucky resident form; however, either or both can be completed in Pathway. For retirees, withholding elections can be changed at any time.

Federal tax

When you retire, you complete a Form W-4P instructing TRS how to withhold federal taxes from your annuity. If you elect to withhold, TRS will withhold federal taxes on the taxable portion of your annuity as calculated using IRS guidelines. If no W-4P is submitted, the IRS requires TRS to withhold the standard amount for a single person with no adjustments.

For other disbursements, such as a refund (or taking a payment of a supplemental benefit after retirement by TRS 4 members), a W-4R is completed as part of the payment application. This instructs TRS how, if the member desires, to withhold additional amounts above what is required from your distribution for federal taxes.

Kentucky resident state tax

TRS offers withholding for Kentucky taxes but does not withhold for other states or local taxing jurisdictions. (Information about the Kentucky state tax rate is available from the Department of Revenue.) If you elect for withholding the flat Kentucky state tax rate, it will be calculated based on the taxable amount after the standard personal deduction and state pension income exclusion. If you elect a fixed amount or percentage, it will be calculated based on the gross annuity amount.

Need help?

- Tax forms may be obtained through the Kentucky Department of Revenue at https://revenue.ky.gov/Get-Help/Pages/Forms.aspx.

- TRS: 502-848-8500, toll free at 800-618-1687

- KPPA: 502-696-8800, toll free at 800-928-4646

- Kentucky Revenue Cabinet: 502-564-4581

- IRS: 800-829-1040